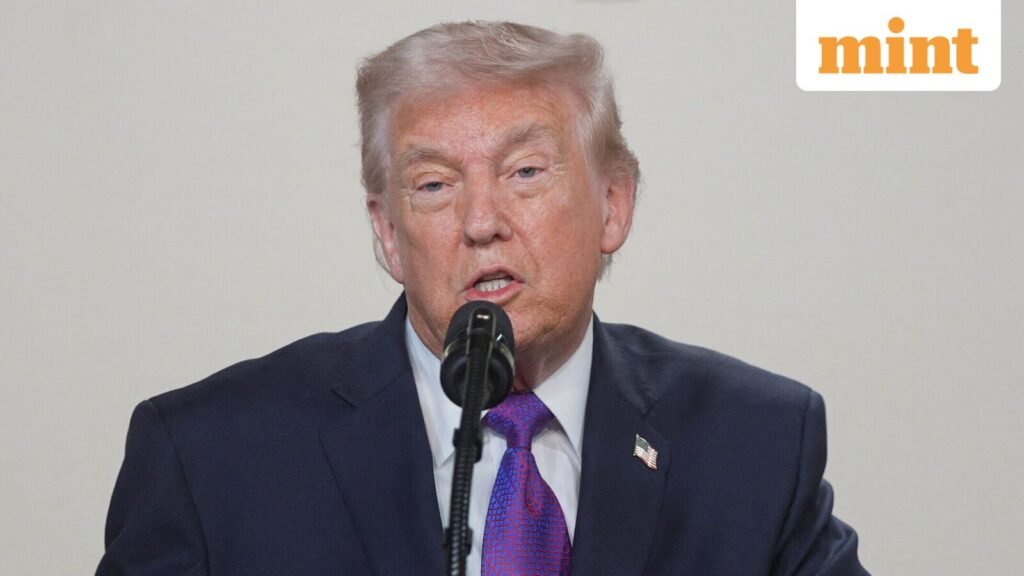

US President Donald Trump appeared on Truth Social on Tuesday (February 17th) to highlight what he called an unprecedented tax refund for Americans this year and to tout his administration’s legislative achievements.

“Tax refunds this year are significantly higher than ever due to the ‘BIG BEAUTIFUL BILL’. In some cases, it is estimated that more than 20% will be returned to the taxpayer,” Trump wrote.

He urged Americans to recognize the benefits of this legislation: “So when you get your tax refund, think about what a great president you have – NO TIP TAX, NO SOCIAL SECURITY TAX FOR OUR GREAT SENIORS, NO OVERTIME TAX, CAR LOAN INTEREST DEDUCTIONS AND SO MUCH MORE. Don’t spend it all this money in one place!”

The White House announces the largest tax cut in US history

The White House on Wednesday (Feb. 18) echoed Trump’s message on X (formerly Twitter), highlighting the scope of the legislation: “President Trump signed the BIGGEST tax cut in American history. This includes no tip taxes, no overtime taxes, and no Social Security taxes — all of which will save Americans money on their annual tax returns!”

The measures are seen as a direct benefit to taxpayers, especially seniors and workers, citing no taxes on tips, overtime pay and Social Security income.

Key things

The “One Big Beautiful Bill” is credited with providing record tax refunds for Americans in 2026.

Tax relief measures include:

-No Social Security tax for seniors

– Car loan interest deductions

“One, Big, Beautiful Bill” brings big tax breaks for tips and overtime

The recently passed One, Big, Beautiful Act is expected to provide substantial federal tax relief to millions of Americans, especially service industry workers, veterans and lower wage earners. The legislation affects federal taxes, credits and deductions, allowing taxpayers to take advantage of the new provisions this filing season.

No tip tax

Employees and self-employed people in tipped occupations — such as waiters, bartenders, salon workers, personal trainers and gig economy workers — may be eligible to deduct tips earned in 2025.

Qualified tips include voluntary cash tips or paid tips received directly from customers or through tip sharing.

Deductions apply to tips reported on Form W-2, 1099-NEC, 1099-MISC, 1099-K, or Form 4137.

Maximum annual deduction: $25,000; for the self-employed, the deduction may not exceed the net income from the trade or business where the tip was earned.

The deduction is phased out for adjusted adjusted gross income above $150,000 ($300,000 for joint filers).

Taxpayers are encouraged to read the official IRS guidance to understand how the “tip tax-free” deduction is calculated.

No overtime tax

The bill also allows individuals to deduct qualified overtime wages that exceed their regular wages, generally the “half” portion of the “time and a half” compensation required by the Fair Labor Standards Act.

The deduction applies to overtime reported on Form W-2, 1099, or other specified statements.

Maximum annual deduction: $12,500 ($25,000 for joint filers).

The deduction is phased out for adjusted adjusted gross income above $150,000 ($300,000 for joint filers).

Available to both apportioning and non-apportioning taxpayers.

Who benefits

This law primarily supports:

-Workers in service industries who rely on tips as part of their income.

-Individuals earning overtime in regulated industries.

-Veterans and lower wage workers seeking federal tax relief.

The new deductions ensure that eligible taxpayers can keep more of their hard-earned income, offering financial relief at a time when many rely on extra earnings from tips and overtime to cover day-to-day expenses.

Read also | Don’t blame billionaires, America’s welfare for their “unfair” economy