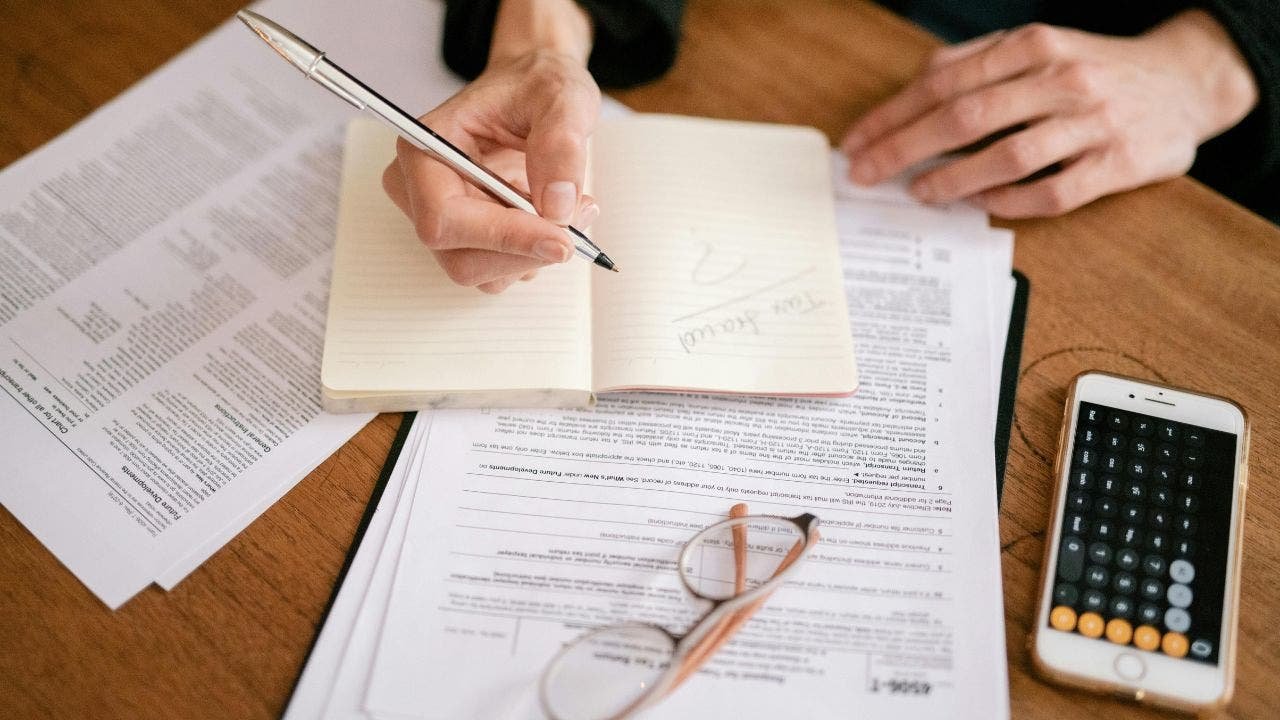

Protect Yourself from IRS Scams and Tax Fraud

Scammers are constantly devising new ways to deceive individuals, whether it’s through fake emails pretending to be your boss, fraudulent calls claiming your Microsoft account has been compromised, or phishing links disguised as package delivery notifications. One of the most common tactics involves impersonating government agencies, particularly the IRS.

The Treasury Inspector General for Tax Administration (TIGTA) has issued a new warning about text message scams targeting taxpayers. These scams often claim to be from the IRS and aim to steal sensitive personal information. Here’s what you need to know to stay protected.

Stay Informed and Secure! Sign Up for CyberGuy Kurt’s Expert Tech Tips and Safety Alerts

New IRS Fraud Warning

The IRS recently issued COVID-19 stimulus payments of up to $1,400 to eligible individuals who missed earlier payments. While most payments were automatic, taxpayers can still claim these funds by filing a tax return by April 15, 2025. Payments are either directly deposited into the taxpayer’s bank account or sent as paper checks.

However, scammers are exploiting this opportunity by sending fraudulent text messages claiming to be from the IRS. These messages often prompt recipients to provide sensitive information like Social Security numbers or bank account details. The IRS has clarified that eligible taxpayers will receive payments automatically—no action is required.

How to Spot Phishing Scams

Phishing scams have become increasingly sophisticated, but here’s how you can identify and avoid them:

- Type of Communication: The IRS never contacts taxpayers via text for sensitive matters like economic impact payments. Official communication is always through mail.

- Suspicious Links: Government websites always end with “.gov”, while fraudulent links often end with “.com” or “.net.”

- Urgency or Threats: Be wary of messages that create a sense of urgency or threaten consequences. Also, watch for typos or unusual characters in links.

10 Ways to Stay Safe from Government Impersonation Scams

- Install Robust Antivirus Software: Protect your devices from phishing links and malware with trusted antivirus software.

- Verify Suspicious Messages: Always confirm the authenticity of unexpected emails or texts by contacting the agency directly.

- Use Strong, Unique Passwords: Create complex passwords for your accounts and consider using a password manager.

- Monitor Your Tax Account: Regularly check your IRS account online to ensure there are no unauthorized activities.

- Report Suspicious Activity: Immediately report any suspected fraud to the IRS or relevant authorities.

- Use Data Removal Services: Protect your personal information by using services that remove your data from data broker websites.

- Opt for Direct Deposit: Choose direct deposit for tax refunds to minimize the risk of fraud.

- Avoid Spoofed Sites: Manually enter the official website address instead of clicking links in emails or ads.

- Invest in Identity Theft Protection: Monitor your personal and financial information with identity theft protection services.

- Stay Educated: Keep up with the latest scams and security tips to stay one step ahead of fraudsters.

Kurt’s Key Takeaways

Tax season often brings an increase in scams targeting taxpayers. Remember, the IRS will never contact you via text for sensitive matters. Always verify the legitimacy of any communication and avoid clicking on suspicious links. By staying vigilant and following these tips, you can protect your personal and financial information from scammers.

Do you think AI makes it easier for scammers to impersonate legitimate organizations like the IRS? Share your thoughts at CyberGuy.com/Contact.

For more tech tips and security alerts, subscribe to the CyberGuy Report Newsletter at CyberGuy.com/Newsletter.

Copyright 2025 CyberGuy.com. All rights reserved.

Kurt “CyberGuy” Knutsson is an award-winning tech journalist and contributor to Tech Word News & Tech Word News. For more tech advice, visit CyberGuy.com.