Center ₹8,276 crore incentive program to promote RuPay debit cards and low-value UPI transactions, which ran from FY22 to FY25, led to an 11-fold growth in digital payments during the period and cemented UPI’s position as India’s dominant payment system, accounting for nearly 80% of total digital transactions, according to an impact study commissioned by the government.

The report titled “Socio-Economic Impact Analysis of Incentive Scheme for Promotion of RuPay Debit Cards and Low Value BHIM-UPI Transactions (Person-to-Merchant)” was released by the Department of Financial Services (DFS) during the Chintan Shivir event held on 13-14 February The study was conducted by an independent third-party research agency in consultation with the National Payments Corporation of India (NPCI), which operates UPI.

The survey included 10,378 respondents in 15 states, including 6,167 users, 2,199 merchants and 2,012 service providers. Face-to-face interviews were conducted from July to August 2025 across five regions – North, South, East, West and North East India.

DFS said the findings could inform future policy design and strengthen support for India’s digital payments ecosystem.

Read also | AI is not UPI: Using the same model could destroy progress in AI

Huge incentives

Launched in FY22, the government’s incentive program was aimed at accelerating the adoption of digital payments by supporting acquiring banks, payment system operators and app providers to process low-value transactions without passing the cost on to merchants or customers. The government provided overall budget support ₹8,276 crore over four years, disbursement ₹1,389 crore in FY22, ₹2,210 crore in FY23, ₹3,631 crore in FY24 and ₹1,046 crore in FY25.The 2026–27 budget provided an additional ₹2,000 crore to support UPI.

According to the report, the incentive support has helped reduce cost barriers, expand merchant registration and strengthen digital payments infrastructure in urban and semi-urban India.

- The number of banks operating on the UPI platform has increased from 216 in March 2021 to 661 by March 2025.

- The number of third-party app providers increased from 16 to 38, signaling renewed participation from fintech players.

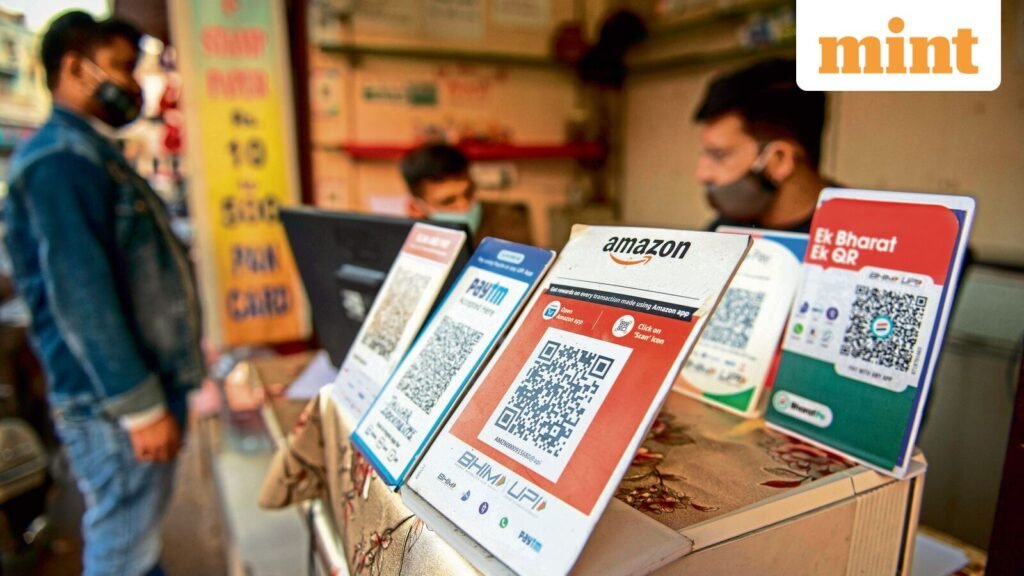

- UPI QR Code deployment has skyrocketed from 93 million to nearly 658 million, enabling widespread adoption by merchants.

UPI payments are now routine

The impact of the system on behavior is equally significant. Among users surveyed, UPI emerged as the most preferred mode of payment at 57%, overtaking cash at 38%. Nearly 65% of UPI users said they conduct multiple digital transactions daily, reflecting its growing role in routine spending.

Adoption is particularly strong among younger users. In the 18-25 age group, 66% prefer UPI, indicating a clear shift towards digital financial habits. Overall, 90% of users reported increased confidence in digital payments after using UPI and RuPay cards, accompanied by a noticeable decrease in cash usage and ATM withdrawals. The study also noted a reduction in the proportion of lower denomination notes, indicating that small-ticket transactions have shifted to digital platforms.

Speed emerged as the strongest driver of adoption, with 74% of UPI users citing it as a primary benefit. This was followed by the convenience of not carrying cash (59%), increased security (53%) and ease of use (52%). Cashback incentives were identified as a key motivating factor by 52% of respondents, which underscored the importance of financial rewards in shaping behavior.

Read also | Sent money to wrong UPI ID? What really happens next

The study also found that UPI’s dominance is expanding across spending categories. It is the most preferred mode for online shopping (64%), subscriptions (61%) and bill payments (58%). Even in traditionally challenging segments like grocery and daily necessities, UPI (48%) overtook cash (43%). For offline shopping and food and entertainment, more than half of the respondents indicated a preference for UPI.

Improved internet access (37%) and improved security features (36%) were among the top factors that users said would further increase the use of digital payments, along with cashback incentives and rewards. Accessibility measures such as popular interfaces and simpler app designs were found to be particularly important for lower-income and first-time users.

What about traders?

On the merchant side, digital adoption is almost universal among small businesses, with 94% reporting that they have adopted UPI. About 72% expressed satisfaction with digital payments, citing faster transactions, better record keeping and operational convenience. Significantly, 57% of marketers reported higher sales after adopting digital modes.

For merchants, fast payments emerged as the top benefit (68%), followed by reduced reliance on cash (48%), convenience (46%) and increased security (43%). Some 38% said digital payments are in line with customer preferences, while 25% pointed to better access to credit thanks to digital transaction records.

The report highlighted that digital payments also contribute to wider socio-economic gains. Increased formalization of transactions creates digital footprints that increase transparency and improve credit ratings. Respondents also recognized systemic benefits such as strengthening the economy (18%), improving the digital payments ecosystem (17%), improving access to credit (16%) and reducing financial inequality (14%).

While UPI’s growth story is firmly established, the report highlighted the need for targeted efforts to increase the use of RuPay debit cards, especially in rural and semi-urban areas. Recommendations include programs aimed at supporting merchants, supporting low-value digital transactions through solutions such as UPI Lite, and continued investment in connectivity, digital literacy and fraud mitigation.

Read also | UPI Loans: Will Credit Card-like Interest Free Period Help?