SBI Ventures, the State Bank of India (SBI)-backed alternative asset manager, intends to raise ₹2,000 crore for its third climate fund to invest in startups.

It will help usher in green growth, a new financial opportunity, SBI Ventures Managing Director and CEO Prem Prabhakar said while addressing the second annual IVCA Green Returns Summit in New Delhi.

Both domestic and global investors will be attracted to the fund and the roadshow will begin early next year, he said.

“We aim to launch the ₹2,000 crore fund in the first quarter of the next calendar year,” he added.

The fund would invest in early- and growth-stage climate start-ups – particularly in frontier climate technologies and climate innovation with artificial innovation.

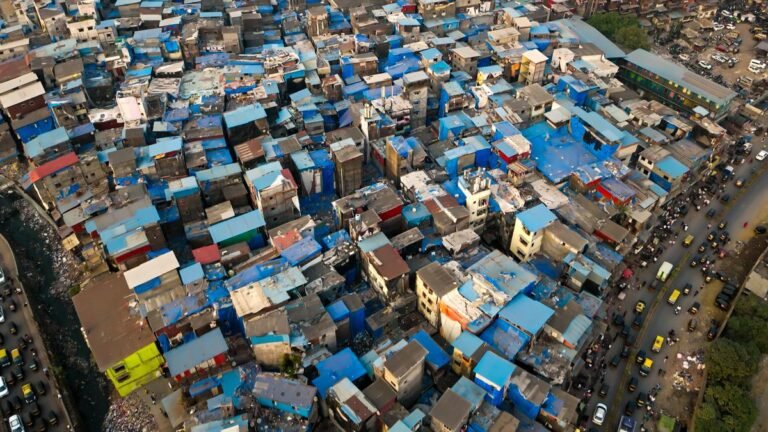

He further said that India is developing into a laboratory and launch pad for global climate innovation, especially in areas such as refrigeration technologies, low-carbon materials, nature-based solutions, waste and circulation.

Mr. Prabhakar pointed to an estimated requirement of US$170 billion annually to meet India’s climate goals, three times the current flow of funds.

According to him, the biggest financial deficits are in the adaptation and resilience sectors, such as water security, climate-smart agriculture and disaster-resilient infrastructure.

He called for a multi-layered climate finance model that combines equity, leveraged capital, philanthropic risk-taking and innovative structures such as climate-resilient bonds and carbon markets.

“Climate finance cannot rely solely on equity,” he said, adding that the ecosystem needs to scale blended finance, de-risk first-of-its-kind technologies and build institutional capacity across the investment chain.

Published – 24 Nov 2025 22:46 IST