Despite the speculative and turbulent nature of these virtual assets, retail investors have shown strong interest in cryptocurrencies. This finding was highlighted in a report released by the International Securities Commission (IOSCO). The Madrid-based Spanish agency said it surveyed 24 jurisdictions to compile the report as “Investor Education for Crypto Assets”. The report released this week highlights the rising interest of large capital investors in Crypto. By focusing on crypto awareness and guidance on education.

In its report, iosco said that even in 2022 the cryptocurrency sector is valued below $1 trillion (approximately Rs 167,09,363 crore), retail investors are continuing to invest in crypto assets. This trend is also evident not only among retail investors in developed economies, but also among retail investors in emerging markets.

“The space for crypto assets has been evolving since 2020, despite volatility in the market, experiencing a significant economy in the 2022 “crypto winter”, retail investors are still investing in the cryptocurrency market, which are investing in these investments “Young, demographic diversified. ”

The report reveals that many young investors in the retail sector are collecting information related to investment from unauthorized random sources. IOSCO is worried that this practice will lead them to financial turmoil.

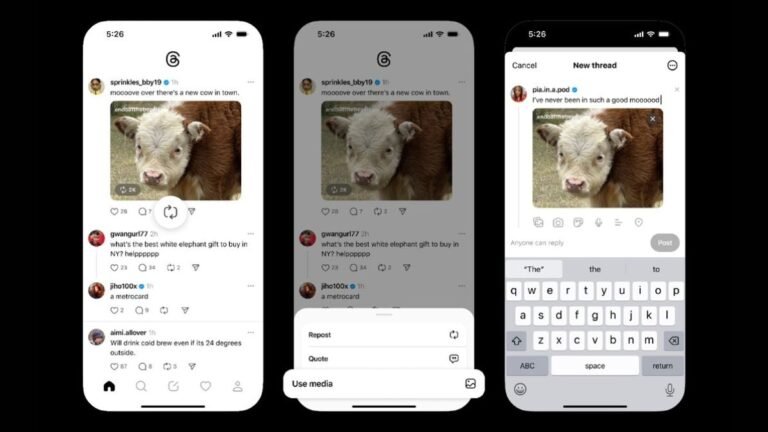

“These investors typically rely on social media to obtain investment information and tend to overestimate their investment knowledge and experience,” the report said.

Financial organizations assert that governments must speed up efforts to encrypt comprehensive regulations tailored for their respective economies. In addition, the report highlights investors’ demand for the protection provided by the regulatory framework and the risks associated with investing in non-compliant crypto assets.

iosco also identified several factors that led to the gap between retail investors’ interest in crypto assets and their unwillingness to fully participate. These factors include extreme price fluctuations, potential losses, system failures, hacker risks, concerns about losing private keys, the spread of fake crypto assets, and the lack of consumer protection.

“Given the widespread lack of compliance in the crypto asset space, fraudulent activity remains widespread and investors are still at a huge risk of losses. Investors including novice investments may not know how to avoid or look for fraud when investing in this area. For regulation It remains an important message to institutions regularly communicate with investors and strengthen the ongoing popularity of fraud,” the report noted.

iosco responded to findings from various research companies and legal agencies, including the FBI, and has recognized in recent years the increasing prevalence of crypto-related fraud.

The report highlights the sharp rise in investment fraud, Ponzi schemes, export scams, pumping schemes, and market manipulation strategies adopted by cybercriminals, urging investors to conduct due diligence before interacting with unfamiliar crypto resources. For younger investors, the report warns that FOMOs should not prompt them to rush to invest in these speculative and largely unregulated assets.

IOSCO is currently working to implement an encrypted framework in its member jurisdictions, serving as a forum for national securities regulators and claims to have 130 jurisdictions under its umbrella. SEBI India is also a member of the board of directors of iosco.