Reducing RBI Rates to Strengthen Economic Growth and Boost Real Estate: Realtors

The Reserve Bank of India (RBI) has been a crucial player in shaping the country’s economic landscape. One of the key tools at its disposal is the repo rate, which is the rate at which it lends money to commercial banks. Recently, the RBI has been considering reducing the repo rate to stimulate economic growth and boost the real estate sector. In this article, we will explore the reasons behind this move and its potential impact on the economy and the real estate industry.

Why Reduce RBI Rates?

The Indian economy has been facing a slowdown in recent years, with growth rates dipping to a six-year low. One of the main reasons for this slowdown is the high interest rates, which have made borrowing expensive for individuals and businesses. By reducing the repo rate, the RBI aims to make borrowing cheaper and increase the flow of credit to the economy. This, in turn, is expected to boost consumption and investment, leading to a pickup in economic growth.

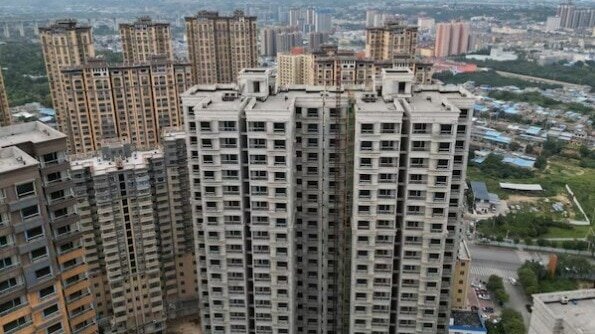

Impact on Real Estate

The real estate sector has been one of the hardest hit by the economic slowdown. High interest rates and strict regulations have made it difficult for developers to access credit and for buyers to purchase properties. A reduction in RBI rates could have a positive impact on the real estate sector in several ways. Firstly, it could make borrowing cheaper for developers, allowing them to reduce their costs and pass on the benefits to buyers. Secondly, it could increase demand for properties as buyers become more confident about their ability to borrow and purchase.

Benefits to Homebuyers

A reduction in RBI rates could also benefit homebuyers in several ways. Firstly, it could lead to a decrease in home loan interest rates, making it cheaper for buyers to purchase properties. Secondly, it could increase the availability of credit, allowing buyers to borrow more easily and purchase their dream homes. Finally, a reduction in RBI rates could lead to an increase in property prices, as demand increases and supply remains limited.

Challenges Ahead

While a reduction in RBI rates could have several benefits, there are also some challenges to consider. One of the main concerns is the potential for inflation to rise, as cheaper borrowing could lead to increased consumption and demand. Another challenge is the potential for a surge in asset prices, which could lead to a bubble in the real estate market.

Conclusion

In conclusion, reducing RBI rates could be a key step in strengthening economic growth and boosting the real estate sector. By making borrowing cheaper and increasing the flow of credit, the RBI can stimulate consumption and investment, leading to a pickup in economic growth. For realtors, a reduction in RBI rates could lead to an increase in demand for properties, as buyers become more confident about their ability to borrow and purchase. However, there are also some challenges to consider, and the RBI will need to carefully balance the benefits and risks of reducing RBI rates.

Recommendations

Based on the analysis above, we recommend that the RBI reduce the repo rate to stimulate economic growth and boost the real estate sector. However, we also recommend that the RBI take steps to mitigate the risks associated with reducing RBI rates, such as inflation and asset price bubbles. Some potential measures could include:

- Implementing measures to control inflation, such as increasing taxes or reducing government spending

- Implementing measures to prevent asset price bubbles, such as increasing capital requirements for banks or implementing stricter regulations on lending

- Monitoring the economy closely and adjusting monetary policy as needed to ensure that the benefits of reducing RBI rates are maximized while the risks are minimized.

By taking a careful and balanced approach, the RBI can help to stimulate economic growth and boost the real estate sector, while also minimizing the risks associated with reducing RBI rates.