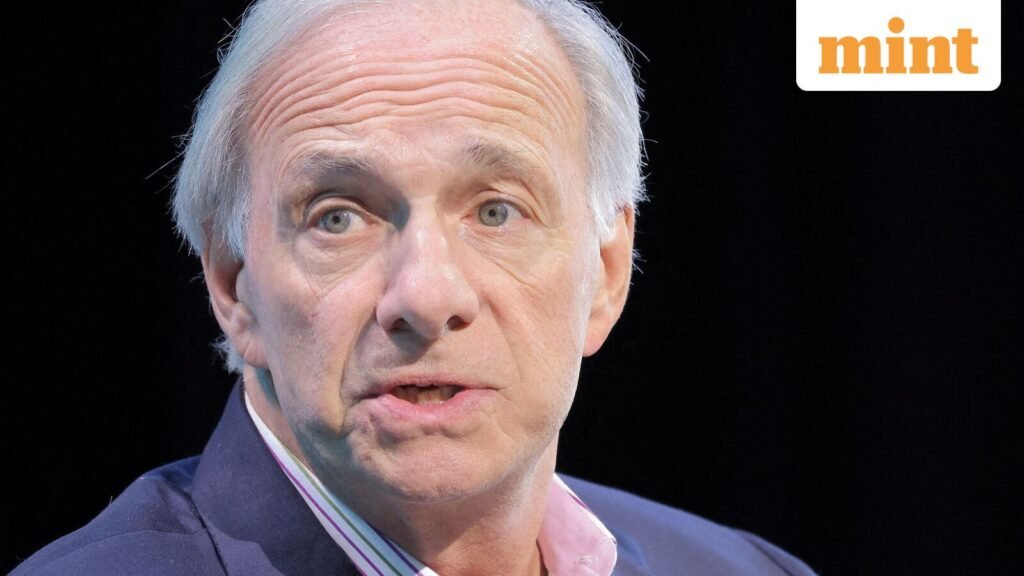

Great questions signal a mind that is learning and evolving, and ace investor Ray Dalio highlighted just that in LiveMint’s current offering.

“Look for people who have a lot of great questions. Smart people are the ones who ask the most thoughtful questions, as opposed to thinking they have all the answers,” he said in his book, “Principles: Life and Work.”

“Great questions are a much better indicator of future success than great answers,” he added.

The book outlines the basic truths that guide actions to achieve success in personal and professional life, with an emphasis on radical transparency and thought meritocracy.

What does this mean:

In this quote, Dalio says that the quality of a person’s questions matters more than the quality of their answers—especially when judging their long-term potential.

He emphasizes that questions matter more than answers because they show curiosity – People who ask thoughtful questions actively seek to understand the world, and curiosity is a driver of learning, innovation and growth.

Questions reveal humility – asking questions means you admit you don’t know everything, and this openness allows you to improve, adapt and avoid overconfidence.

Dalio believes that questions indicate critical thinking; thoughtful questions show that one can analyze situations, see hidden assumptions and identify risks and opportunities.

He also emphasized that answers can be temporary – the “right answer” today may be out of date tomorrow. But being able to ask the right questions helps you keep finding new answers.

Ray Dalio calls gold the best place to store money

Ray Dalio, the billionaire investor and founder of hedge fund Bridgewater Associates, recently endorsed gold as the best place to put money as prices of the precious metal bounced back strongly after a brief dip amid the sell-off.

Dalio called gold a safe investment because it “doesn’t change from day to day.”

Instead of thinking about buying it, central banks and sovereign wealth funds should be asking how much gold should be allocated in their portfolios, according to the ace investor.

“Because gold is a diversifier, when times are bad it does exceptionally well and when times are prosperous it does less well, (but) it is an effective diversifier,” he said.