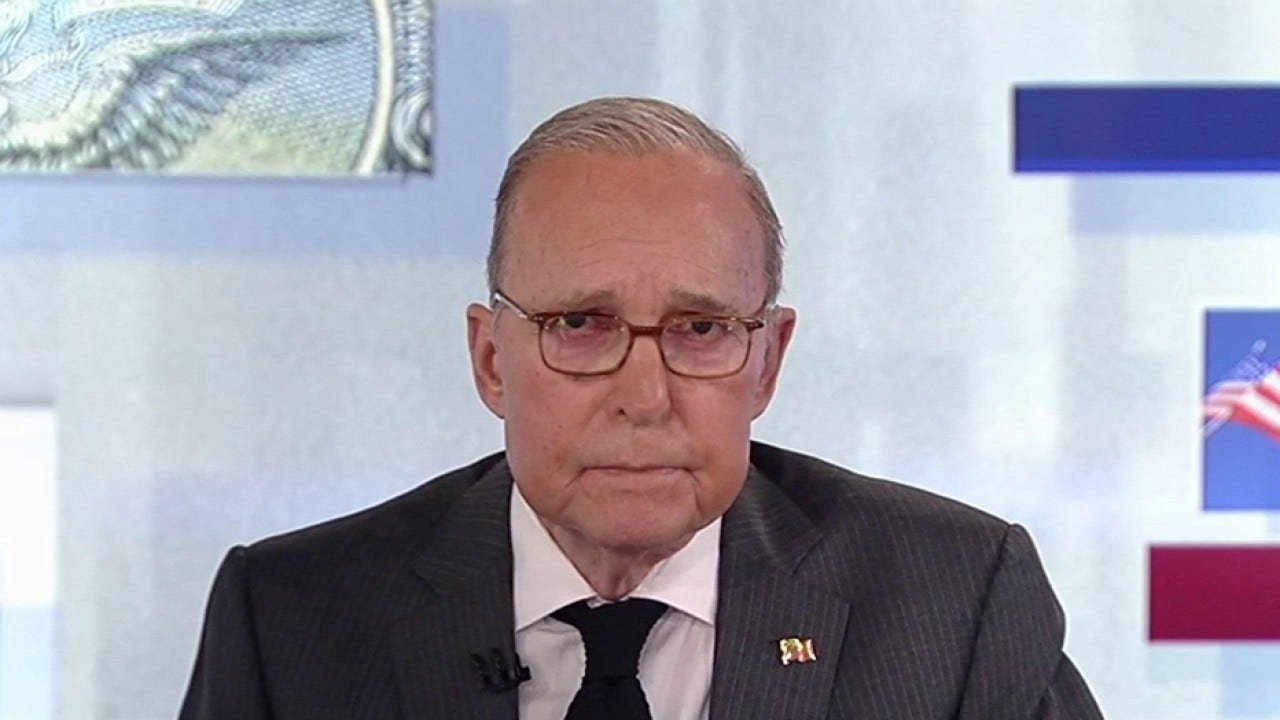

Title: Markets Applaud Trump’s Mutual Tariffs, Echoing Larry Kudlow’s Stance

Donald Trump’s decision to impose tariffs on steel and aluminum imports has sparked a heated debate, but one of his top economic advisors, Larry Kudlow, has been a vocal supporter of the move. As the White House Director of the National Economic Council, Kudlow has consistently advocated for a protectionist approach, arguing that tariffs will help to rebalance the global trade landscape and benefit American businesses.

Kudlow’s stance has been met with widespread skepticism from many economists and trade experts, who warn that tariffs will lead to higher prices, reduced economic output, and retaliatory measures from other countries. However, despite these concerns, stock markets have thus far responded positively to the news, with the Dow Jones Industrial Average and the S&P 500 Index experiencing significant gains in the wake of the tariff announcement.

There are several reasons why markets may be applauding Trump’s move. For one, the tariffs are seen as a bold step towards re-establishing America’s economic standing on the global stage. Many investors believe that the tariffs will help to shift the focus away from globalization and towards more domestic production and job creation. This shift is seen as a way to boost the economy, create jobs, and increase wages, which could have positive effects on the broader market.

Another reason why markets are responding positively to the tariffs is that they may lead to a more balanced trade environment. Kudlow and other Trump administration officials argue that the current trade regime has been unfairly biased in favor of other countries, particularly China, which has been accused of widespread intellectual property theft and unfair trade practices. The tariffs are seen as a way to level the playing field, allowing American businesses to compete more effectively in the global market.

Finally, the tariffs may be seen as a sign of Trump’s commitment to putting America’s interests first. This has been a central theme of his presidency, and the tariffs are seen as a tangible example of his willingness to take bold action to benefit American workers and businesses.

Despite the market’s initial enthusiasm, however, the long-term impact of the tariffs remains uncertain. Retaliatory measures from other countries, particularly China, could have significant consequences for the US economy. Additionally, the tariffs may lead to higher inflation, which could erode the purchasing power of consumers and reduce the value of the dollar.

As the situation continues to unfold, investors will be closely watching for developments, including the potential for future tariffs on other goods and services. Meanwhile, Kudlow’s stance on the issue remains a key factor in shaping the administration’s approach to trade policy. With his background in economics and experience in the private sector, Kudlow is well-positioned to advise the president on the complex and often fraught issue of trade.

For now, however, the markets are responding positively to Trump’s bold move, and investors are optimistic about the potential benefits of a more protectionist approach. As the situation continues to evolve, one thing is clear: Larry Kudlow’s influence on the president’s decision-making process has been significant, and his support for the tariffs has contributed to the markets’ initial enthusiasm for the move.