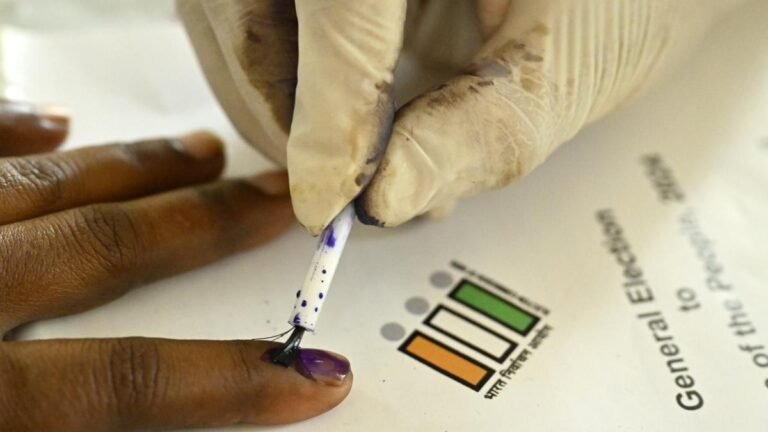

The aim of the rationalization of GST and structural reforms was aimed at making aspiration goods available to people, said K. Balasubramanian, a common secretary, the Ministry of Finance, the Indian government.

He spoke at the GST 2.0 workshop – developed another era of GST: simplification, technology and EODB, organized by Bangalore Chamber of Industry and Commerce (BCIC) on Thursday.

“The government has announced a wide reform of GST since September 22, focusing on three pillars: structural reforms, value rationalization and processes improvement,” he said.

Mr. Balasubramanian said that the exercise focused on structural reforms to solve long -term questions, such as inverted tax regimes in sectors such as fertilizers and textiles, and at the same time simplified the Tax Act by consolidating 12% of the 5% Merit holder). “The aim of this rationalization is to make aspiration goods available,” he said.

DP Nagendra Kumar IRS, a former member, GST, Central Council of Indirect Taxes and Customs (CBIC), stressed that significant revenue growth, while the monthly collections now reach approximately 1.85 Lakh Crore, was “purely because of the economic efficiency of tax collection”.

Published – September 18 2025 9:14