Getty Images Holdings Inc. agrees to acquire rival stock provider Shutterstock Inc. in a deal that will create a merged company worth about $3.7 billion (approximately Rs 3176 crore), including debt.

According to a statement Tuesday, Getty Images offers cash payments of about $28.85 (about Rs 2,476), about 13.67 shares of Getty Images stock per ShutterStock shares. Shutterstock shareholders can also choose to pay in a mix of cash and Getty stock.

For the transaction, Getty Images is expected to pay US$331 million (approximately Rs 2841 crore) in cash and 319.4 million shares of its own shares. Upon completion, Getty Images holders will own approximately 54.7% of the merged company, while Shutterstock shareholders will own the remaining shareholders. Getty Images CEO Craig Peters will hold the same position as the joint entity.

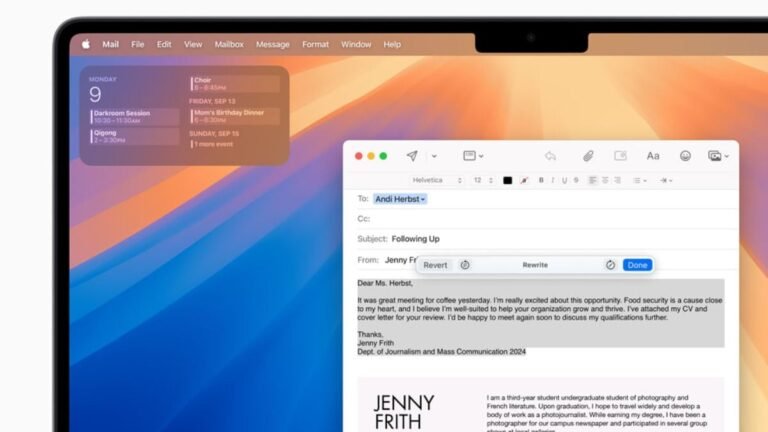

The deal brings together two of the largest licensed visual content providers in the United States as artificial intelligence disrupts the content creation market and mobile cameras dilute the value of stock photos. It will combine Shutterstock’s vast searchable platform with Getty Images’ huge library of photos, illustrations and videos, which enables contributors to upload their content.

By the end of Monday, Getty Images (debt of approximately US$1.4 billion (approximately Rs 12,0117 crore) – lost about 73% of its market value since it went public through a blank check deal in July 2022. In the same Shutterstock has dropped by about 50% during the period. Shutterstock has jumped as much as 44% in listing trading after Tuesday’s announcement, while Getty has soared as much as 100%.

The two companies are fusing together, and they can reduce costs and increase profitability by providing a wider range of services to the media, advertising and content creation industries.

Antitrust insurance

After the Biden administration blocks high-profile deals between supermarkets and airlines, pairing will also be an early test of the Trump administration’s merger among a rather concentrated leading industry players. While the deal may cause rigorous scrutiny, it highlights how optimistic it is with the public, as regulators will have a easier touch in at least some departments.

Seattle-based Getty Images is co-founded by Mark Getty, chairman of the wealthy Getty family. He is a director of Getty Investments, which accounts for 43% of the company’s outstanding shares, according to data compiled by Bloomberg.

The company has moved in and out of the public market over the past few decades, changing hands several times. Hellman & Friedman took it private in 2008 and sold it to Carlyle Group Inc. four years later. The Getty family controlled the company in 2018 and sold a minority stake to the investment arm of Koch Industries Inc. that year.

The family agreed in 2021 to merge the company with blank inspection vehicles supported by CC Capital and Neuberger Berman.

Berenson & Co. and JPMorgan Chase & Co. is a financial advisor to Getty Images, and Allen & Co. is a financial advisor to Shutterstock.

©2025 Bloomberg LP

(This story has not been edited by Tech Word News’s staff and is automatically generated from the joint feed.)