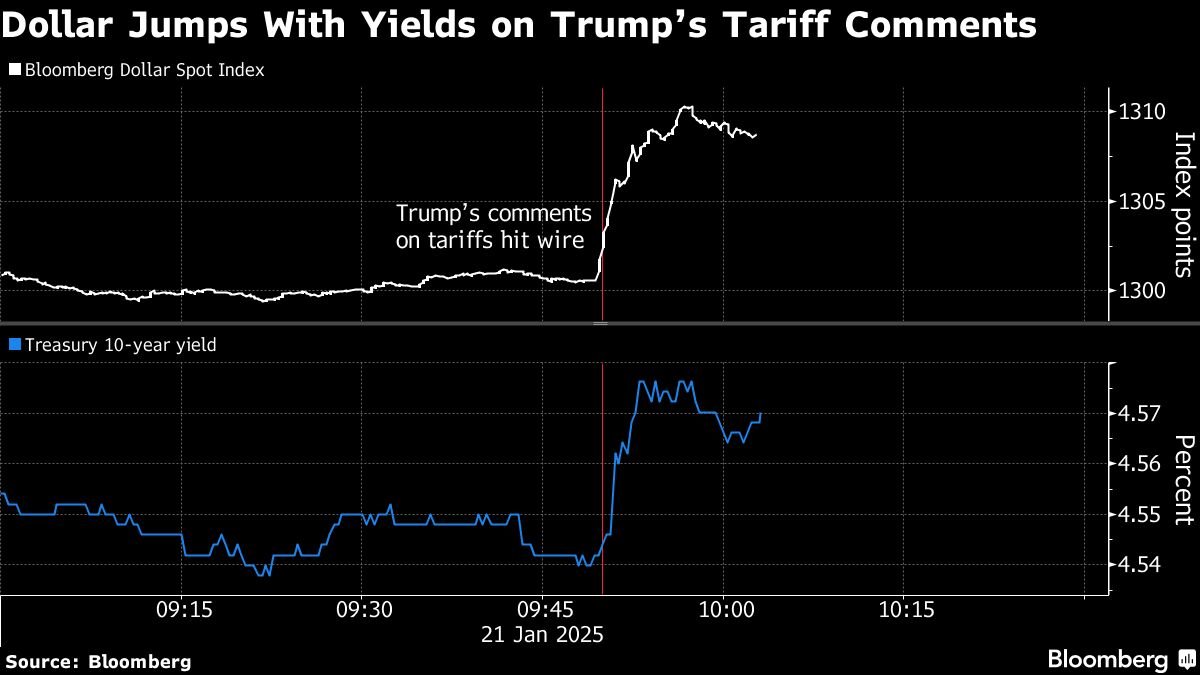

Dollar Rebounds as Trump Eyes More Tariffs on Canada and Mexico

The US dollar index has surged to its highest level in over a week, as investors await a potential decision by President Donald Trump to impose more tariffs on Canada and Mexico. The dollar index, which measures the value of the US currency against a basket of six major currencies, rose 0.3% to 98.57, its highest level since March 20.

Trump has threatened to impose 5% tariffs on all goods imported from Canada and Mexico, which would be in addition to the existing 25% tariffs on iron and steel products from both countries. The proposed tariffs are part of the ongoing trade tension between the US, Canada, and Mexico, which has seen tit-for-tat measures and threats of trade barriers.

The dollar’s rebound comes amid concerns that the tariffs will increase the cost of goods and spur inflation, which could erode the Federal Reserve’s pause in interest rate hikes. However, many analysts expect the tariffs to have only a limited impact on the broader economy, as the US has a strong job market and low unemployment.

"The dollar’s strength is driven by the perception that the US economy is strong and resilient, and that the tariffs will have a limited impact on the overall economy," said Jim O’Shaughnessy, chief executive of O’Shaughnessy Asset Management. "The market is also reacting to the hope that a deal can still be reached between the US, Canada, and Mexico to avoid a trade war."

Despite the dollar’s strength, the safe-haven currencies such as the Japanese yen and Swiss franc have remained range-bound, reflecting the ongoing uncertainty surrounding the global trade outlook. The euro also remained under pressure, down 0.2% against the dollar, as investors remain concerned about the ongoing Brexit negotiations and the potential impact on the European Union’s economy.

The Canadian dollar was down 0.3% against the US currency, as the threat of tariffs on Canadian agricultural products and the impact on the country’s trade-sensitive sectors weighed on the currency. The Mexican peso was also under pressure, down 0.4% against the US dollar, as the country’s economy has been vulnerable to external shocks in the past.

Ultimately, the direction of the dollar, as well as the global currency market, will depend on the outcome of the trade negotiations between the US, Canada, and Mexico. A deal that avoids tariffs would likely see the dollar weaken, while a trade war would lead to a strong dollar.

As the situation remains fluid, investors will continue to keep a close eye on the developments, seeking to position themselves accordingly. For now, the dollar’s strength has provided a respite, but the uncertainty surrounding the global trade outlook remains a major concern for markets.