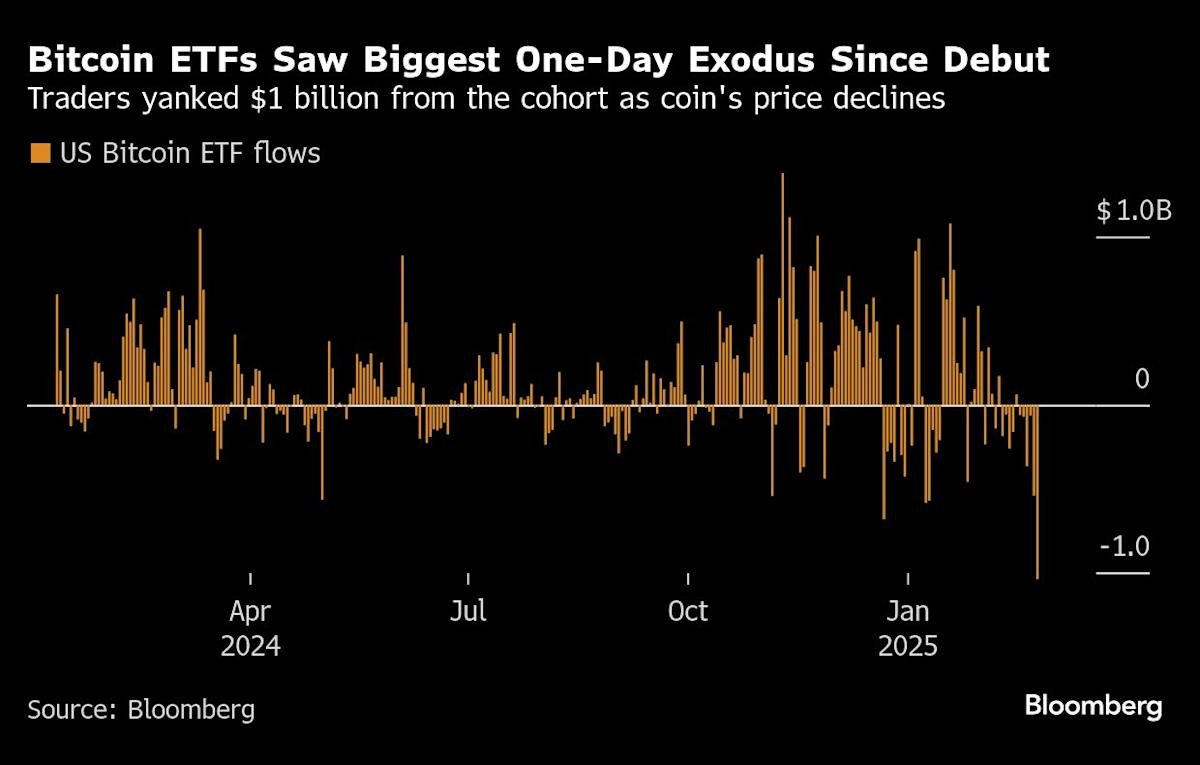

Bitcoin ETFs Suffer Record Outflow of $1 Billion Daily as Market Sentiment Turns Bearish

The cryptocurrency market, particularly in the United States, is witnessing an unprecedented exodus of investors from Bitcoin exchange-traded funds (ETFs). According to recent data, more than $1 billion is being drained from these funds daily, marking a record high outflow in the history of the asset class.

This astonishing outflow is attributed to a sudden shift in investor sentiment, with many now questioning the future prospects of the world’s largest cryptocurrency, Bitcoin. The price of Bitcoin, which has been volatile in recent months, has been declining steadily, leading to widespread concerns about the asset’s sustainability.

Exchange-traded funds (ETFs) are a popular investment vehicle for investors looking to gain exposure to the cryptocurrency market without directly buying or holding the underlying assets. Several prominent ETFs, such as the ProShares Bitcoin Strategy ETF (BITCOMPETED) and the VanEck Bitcoin Strategy ETF (XBTF), have been hit the hardest, with many investors opting to sell off their positions and exit the market.

The outflow can be attributed to a combination of factors, including:

- Increased regulatory scrutiny: The cryptocurrency market has been subject to increased regulatory pressure, with many countries introducing stricter guidelines and regulations. This has led to widespread uncertainty among investors, causing many to reassess their exposure to the asset class.

- Declining price of Bitcoin: The price of Bitcoin has been fluctuating wildly, making it increasingly difficult for investors to gauge the asset’s value. The recent decline in price has led to a perfect storm of bearish sentiment, as many investors seek to cut their losses and avoid further exposure to the sell-off.

- Market volatility: The cryptocurrency market is notorious for its extreme volatility, making it challenging for investors to predict the actual value of the asset. The recent price drop has led to increased uncertainty, with many investors seeking to exit the market to avoid further losses.

While the current situation appears bleak, experts believe that the Bitcoin ETF market will eventually stabilize and recover. "This is a typical correction in the market, and we expect things to settle down once the dust settles," said a market analyst at a leading investment firm. "Investors should keep an eye on fundamentals and wait for a recovery in price before re-entering the market."

For now, investors are advised to exercise caution when considering exposure to Bitcoin ETFs. The recent outflow, while record-breaking, may present an opportunity for bargain hunters to enter the market at a lower price. However, it is crucial to carefully assess the risks associated with investing in cryptocurrencies and consult with a financial advisor before making any investment decisions.

In conclusion, the current situation highlights the importance of risk management and due diligence in the world of cryptocurrencies. While the future of Bitcoin remains uncertain, it is critical for investors to remain informed and adaptable in response to changing market conditions.