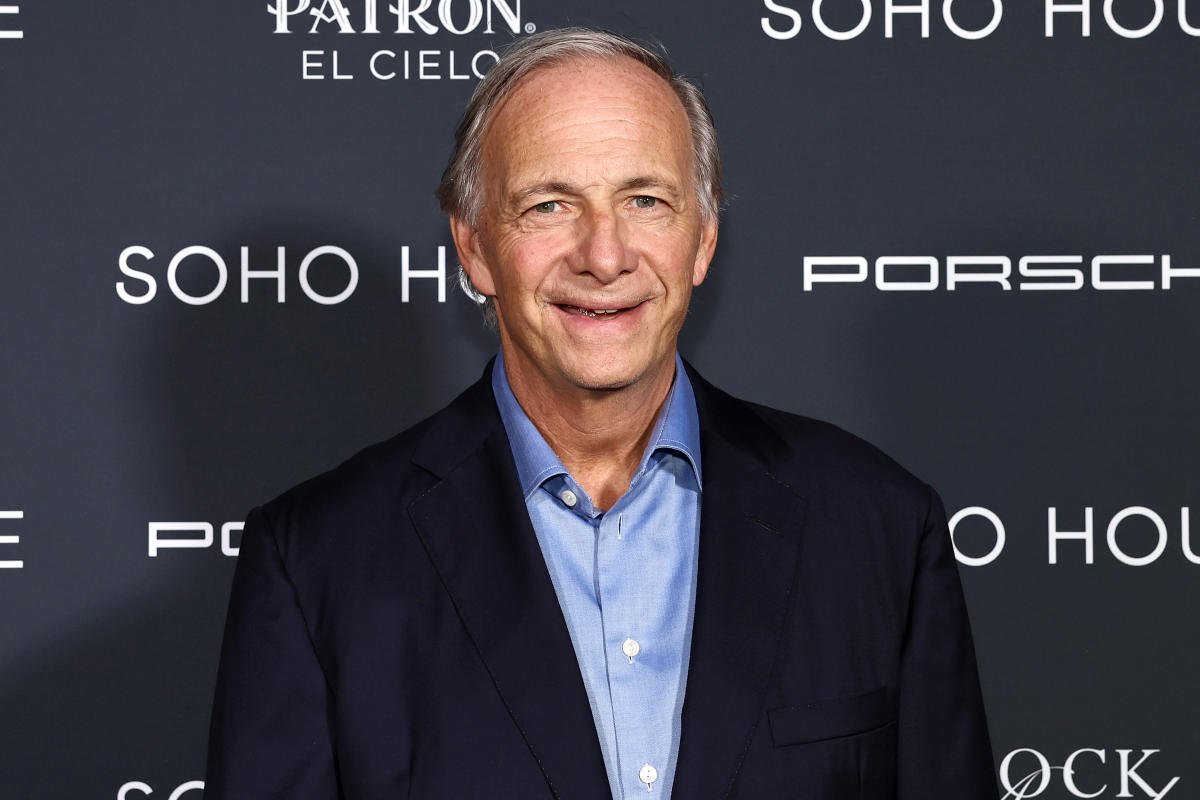

Billionaire Ray Dalio Offers Fresh Tips on How to be a Better Investor

Ray Dalio, the billionaire founder of Bridgewater Associates, the world’s largest hedge fund, has shared his expertise on how to be a successful investor. In a recent interview, Dalio offered valuable insights and tips on how to navigate the complexities of the financial markets and achieve long-term success.

Tip 1: Understand Your Emotions

Dalio emphasized the importance of understanding one’s emotions when making investment decisions. He believes that fear and greed are the two primary emotions that can lead to poor investment choices. "When you’re fearful, you’re more likely to make mistakes, and when you’re greedy, you’re more likely to take on too much risk," he said. To mitigate these emotions, Dalio recommends taking a step back, reflecting on your emotions, and making decisions based on rational thinking.

Tip 2: Focus on the Big Picture

Dalio stresses the importance of having a long-term perspective when investing. He advises investors to focus on the big picture, rather than getting caught up in short-term market fluctuations. "The market is always going to go up and down, but if you focus on the big picture, you’ll be better equipped to make informed decisions," he said.

Tip 3: Diversify Your Portfolio

Dalio believes that diversification is key to a successful investment strategy. He recommends spreading your investments across different asset classes, sectors, and geographies to minimize risk. "Diversification is not just about spreading risk, it’s also about capturing opportunities," he said.

Tip 4: Don’t Try to Time the Market

Dalio advises investors against trying to time the market, as it is a futile effort. "Trying to time the market is a losing game, as no one can consistently predict what will happen," he said. Instead, he recommends adopting a disciplined investment approach and sticking to your strategy.

Tip 5: Learn from Your Mistakes

Dalio believes that learning from your mistakes is an essential part of becoming a better investor. He advises investors to reflect on their mistakes, identify what went wrong, and use that knowledge to improve their investment strategy. "Mistakes are an opportunity to learn and improve, so don’t be afraid to make them," he said.

Tip 6: Stay Informed, but Don’t Get Caught Up in the Noise

Dalio recommends staying informed about market developments and economic trends, but warns against getting caught up in the noise. "There’s a lot of information out there, but not all of it is relevant or useful," he said. He advises investors to focus on credible sources and avoid getting distracted by market rumors and speculation.

Conclusion

Ray Dalio’s tips offer valuable insights for investors looking to improve their investment skills. By understanding their emotions, focusing on the big picture, diversifying their portfolio, avoiding market timing, learning from their mistakes, and staying informed, investors can increase their chances of success in the financial markets. As Dalio himself said, "Investing is a game of skill, not luck. With discipline, patience, and a willingness to learn, anyone can become a better investor."