Title: Why Congress Republicans Must Not Stop Trump’s Tax Cuts

As the Senate considers the fate of President Trump’s proposed tax overhaul, a crucial decision looms large: will Congress stop the much-needed and long-overdue tax cuts, or will it act to bring relief to the American people? For sake of economic growth, job creation, and individual freedom, Congress Republicans must not stop Trump’s tax cuts.

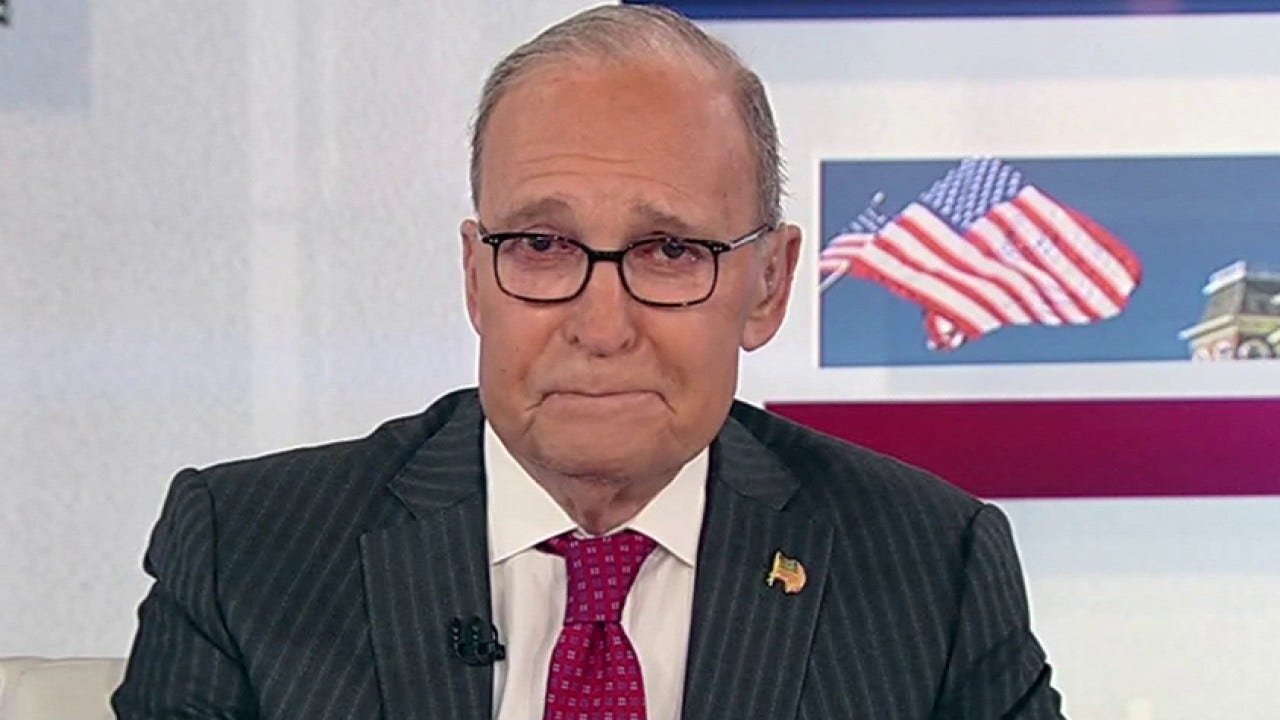

Larry Kudlow, Director of the National Economic Council and a leading voice on economic policy, has been a strong advocate for the President’s plan. In a recent op-ed published in The Wall Street Journal, Kudlow made a compelling case for why these tax cuts matter.

Under the current tax code, which dates back to the 1980s, the US has one of the highest corporate tax rates in the world. This punitive tax environment has led to a brain drain, with many American companies pulling up stakes and relocating abroad in search of more favorable tax climates. The result is a shrinking US economy, stagnant wages, and limited opportunities for the next generation of entrepreneurs.

The Trump plan, in contrast, aims to bring the corporate tax rate down to 20%, in line with other developed economies. This would be a significant reduction from the current 35% rate, which has only served to stifle growth and entrepreneurship. A lower corporate tax rate would incentivize businesses to invest, hire, and expand in the US, rather than abroad.

Moreover, the Trump plan includes a significant reduction in individual tax rates, with the top bracket falling from 39.6% to 35%. This would put more money in the pockets of American workers, allowing them to save, invest, and spend more, thereby boosting consumption and economic growth.

But the benefits of the Trump tax cuts extend beyond simple arithmetic. They would also promote fairness and prosperity by leveling the playing field for small businesses and start-ups, which have been disproportionately burdened by the existing tax code. The plan’s pro-growth provisions, such as increased expensing for equipment and property, would encourage small businesses to invest in their operations, hire more workers, and take risks, driving innovation and job creation.

Kudlow’s article highlights the real-world benefits of tax reform, citing the success of similar policies implemented by Chancellor Angela Merkel in Germany and former President Ronald Reagan, who lowered the top marginal rate from 70% to 28%. Both moves sparked economic growth, increased employment, and improved living standards for their respective countries.

In conclusion, as Congress deliberates on the President’s tax plan, it is crucial that Republicans stand united in supporting these much-needed reforms. Kudlow’s impassioned case highlights the importance of a competitive tax environment, where businesses can thrive and individuals can prosper. It is time for Congress to put the interests of the American people first, rather than the special interests of the established order. Let us hope that our elected representatives will heed the wisdom of Larry Kudlow and other sound voices, and pass a tax overhaul that will put America first.