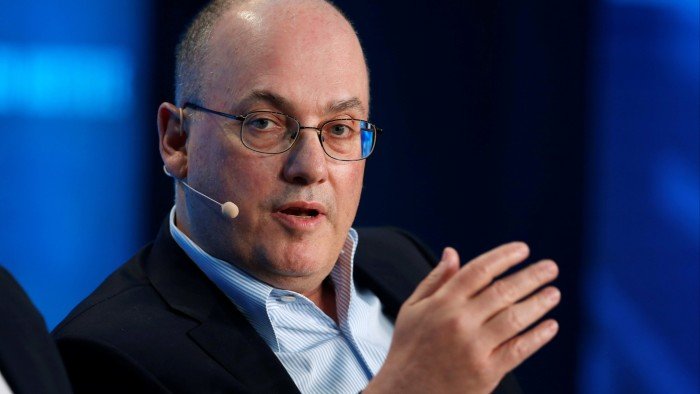

Hedge Fund Giant Steve Cohen Still "Bull" on AI After Major Sale

New York, NY – Steven A. Cohen, the billionaire founder of Point72 Asset Management, has made headlines in recent weeks with the sale of his company’s entire stake in AirBnB and Uber, substantial valuations off from their IPO prices. However, despite this major sale, Cohen remains optimistic about the future of Artificial Intelligence (AI) and its potential to transform industries.

In a recent interview with Bloomberg, Cohen stated, "I’m still a big believer in AI. I think it’s one of the most promising areas of technological innovation in the world." This declaration is significant, given the significant percentage of Point72’s assets that had been dedicated to these two companies. The sale of his positions in AirBnB and Uber has allowed Cohen to redeploy his funds into other opportunities, including AI-focused investments.

Cohen’s enthusiasm for AI is not a new development. In 2017, he dedicated a significant portion of his firm’s funds to AI-based investments, recognizing the potential for the technology to disrupt traditional industries. His firm’s investments in AI-focused companies, including startup accelerators and venture capital funds, have yielded impressive returns, according to sources familiar with the matter.

The hedge fund giant’s confidence in AI is not limited to just the tech industry. He believes that AI will have a profound impact on various sectors, from healthcare to finance, and real estate. "AI is going to change the way we live and work," Cohen emphasized in the interview. "The sheer amount of data that we’re generating is just staggering, and AI is the only way to make sense of it all."

Moreover, Cohen is not alone in his bullishness on AI. Many of the world’s top investors, including Bill Gates, Mark Zuckerberg, and Reid Hoffman, also share his enthusiasm for the technology. In fact, a recent survey conducted by the private equity firm, KKR, found that nearly 90% of institutional investors believe AI will have a significant impact on their investment decisions in the next three to five years.

The sale of Cohen’s stakes in AirBnB and Uber may have generated significant headlines, but it does not dim his faith in the potential of AI. Instead, it reflects his ability to adapt to changing market conditions and capitalize on new opportunities. As one of the most successful hedge fund managers in the world, Cohen’s opinion on AI matters, and his continued "bullishness" on the technology is likely to attract attention and attention from investors around the world.

In conclusion, Steve Cohen’s sale of his stakes in AirBnB and Uber serves as a reminder of his firm’s ability to navigate the ever-changing landscape of the financial markets. However, his continuing optimism about AI’s potential is a testament to his commitment to identifying the most innovative and impactful technologies, and his confidence in the sector’s future growth prospects. As investors continue to seek out opportunities in the AI space, Cohen’s moves are likely to be closely watched, and his stance on the technology will undoubtedly shape the investment landscape for years to come.