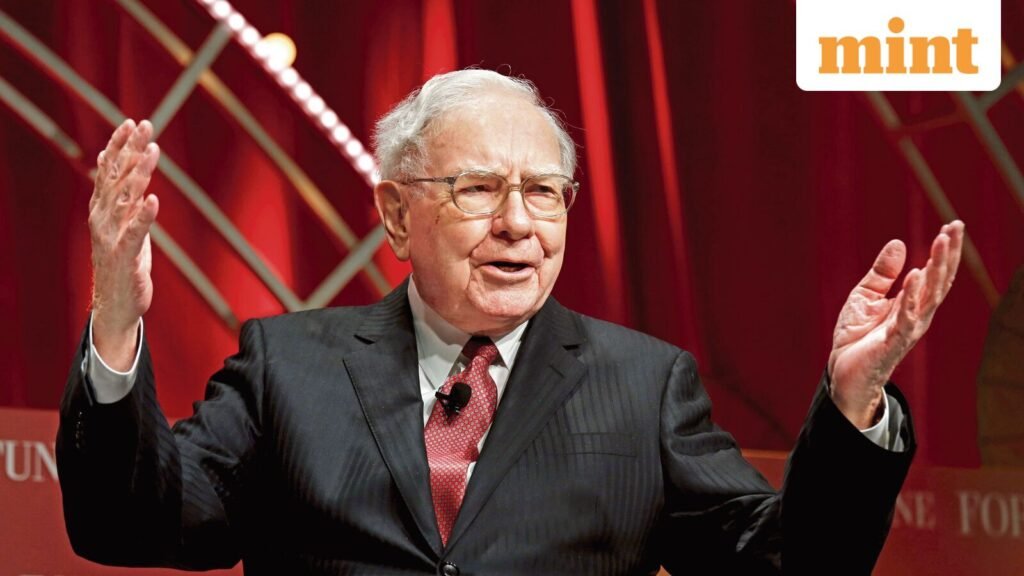

Berkshire Hathaway founder and chairman Warren Buffett is known for his wealth of investment advice over the years. A few such pointers circulating on social media include Buffett’s emphasis on keeping it simple, weighing the pros and cons, and holding stocks to see the upside instead of selling at the first spike.

Quote of the day from Warren Buffett

“Until you can control your emotions, don’t expect to manage money.”

Read also | Quote of the Day by Charlie Munger: “You have to be ready to act on opportunities”

What does Warren Buffett’s quote mean?

This quote is part of Warren Buffett’s long-term investment philosophy. In 2018, the Oracle of Omaha told CNBC that the longer you hold a stock, the less risky it becomes, and that selling is a “stupid thing” when the stock price drops.

He opined that stock price movements were “nothing” compared to businesses earning 12% on stocks and reinvestments, adding that the S&P “has been earning a lot more on physical stocks for decades,” which translates into higher prices.

“The way people think about it (investing in stocks, bonds, etc.) is that they’re doing very stupid things. Some people shouldn’t own stocks at all because they’re just too upset about price fluctuations. If you’re going to do stupid things because your stocks are going down, you shouldn’t own stocks at all,” he said.

He added that some investors are not “emotionally or psychologically equipped” for the ups and downs of stock ownership, but it was not impossible. “I think there will be more if you educate yourself on what you’re actually buying, which is part of the business, and the longer you hold the stock, the less risky it becomes,” he believed.

Read also | Quote of the Day by Paul Graham: ‘Do you want to be like these people?’

Warren Buffett on “seizing big opportunities”

Warren Buffett, known for his long-term approach to stocks, clinging to fundamentals and thoughtful but thoughtful risks, gave students at the Terry College of Business at the University of Georgia some evergreens in 2001 on how to seize opportunities and measure risk using the “20-slot punched card” method.

“Big opportunities in life must be taken. We don’t do too many things, but when we get an opportunity to do something that is right and big, we have to do it,” he said, adding that taking such opportunities in small measures “is as big a mistake as not doing it at all.”

He added that it would be better to think of opportunities as 20 chances on a punch card, where “every financial decision you made, you used up a shot.” He explained: “You would get very rich because you would think very hard about everyone.” He added that the limited chances to invest mean that one will spend time thinking and weighing the pros and cons instead of making rash and impulsive decisions.

Read also | Peter Steinberger Joins OpenAI, Altman Says; lead a next-generation AI personal agent

Who is Warren Buffet aka ‘Oracle of Omaha’

Warren Buffett, along with friend and business partner Charlie Munger, were the architects who transformed Berkshire Hathaway Inc. over nearly 60 years. from a failing textile manufacturer to an empire worth billions. Decades of compounding returns have made the pair of billionaires and folk heroes adoring investors.

Notably, in January of this year, Buffett handed over the reins and the position of CEO to successor Greg Abel. However, his “bull run” with Berkshire is legendary – over 60 years (1964-2024), he generated over 55,00,000% returns, built the group to $1.2 trillion and expanded its Class A shares to a value of $167 billion.

Known as the ‘Oracle of Omaha’ for his mysterious stock forecasting, Buffett gained fame and investor confidence by picking companies (Apple, Bank of America, Coca-Cola, etc.) that exploded and now make up 70% of Berkshire’s $263 billion stock portfolio. He called it how “one great deal can balance out the many mediocre decisions that are inevitable”.

Buffett’s net worth is estimated at $152 billion, making him the 10th richest person in the world, according to the Bloomberg Billionaire Index.